Introduction: The Bitter Side of Sweet Kernels

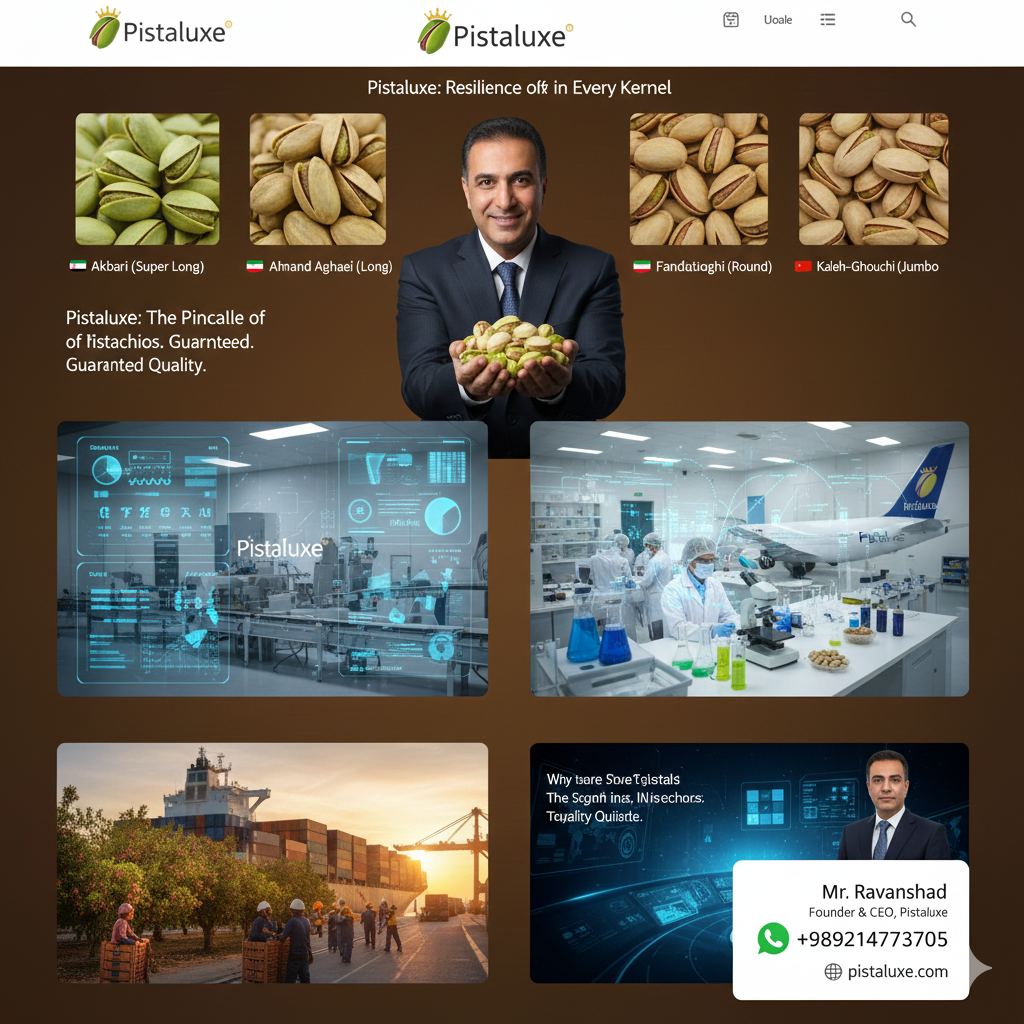

The pistachio trade, often called “Green Gold” in Iran, is a high-stakes game. While the world sees the premium Akbari or Ahmad Aghaei varieties on shelves, the exporters face a volatile reality. This is the story of a real deal that went south due to currency fluctuations and how that failure became the blueprint for our current, unshakeable business model.

The Story: When a 48-Hour Delay Cost a Fortune

In 2018, we secured a major contract to export 25 tons of premium Long Pistachios (Akbari) to a distributor in the EU. At the time of signing, the exchange rate was relatively stable. We calculated our margins at a healthy 12%.

The mistake? We waited 48 hours to convert the Rial liquidity into the foreign currency needed for shipping insurance and international logistics fees. Within those two days, the Iranian Rial devalued by nearly 20% against the Euro. Suddenly, our “profit” evaporated, and we were looking at a massive deficit just to fulfill the shipping obligations.

The Turning Point: Lessons from the Abyss

I realized that in the Iranian market, time is not just money—time is a variable risk. To survive, we had to stop acting like traditional traders and start acting like financial risk managers.

- Instant Settlement Policy: We implemented a “Zero-Hour” conversion rule. The moment a price is locked with a buyer, the equivalent value is hedged or settled with the orchards to prevent currency gaps.

- The “Buffer Clause”: We began educating our international clients on the “Economic Force Majeure” clause, allowing for price adjustments if the currency fluctuates beyond a 5% margin.

- Vertical Integration: We realized that depending on middle-men increased our exposure. By working directly with farmers under the supervision of experts like Mr. Ravanshad, we eliminated unnecessary layers of financial risk.

Why This Matters for You

When you buy from a trader who has survived these “currency storms,” you aren’t just buying nuts; you are buying a stable supply chain. Our failure taught us how to protect your investment from market volatility

Post a comment Cancel reply

Related Posts

Logistics Engineering and Environmental Control in Global Pistachio Supply Chains

IntroductionThe transition of cargo through diverse climatic zones—from the arid regions of the Middle East…

Biochemical Stability and Mycotoxin Mitigation in Long-Haul Pistachio ExportAbstract

The preservation of pistachios (Pistacia vera L.) during extended maritime or overland transit is a…

The Green Revolution in Food Science: Pistachios as a Biomimetic Substitute for Animal Proteins and Savory FatsIntroduction

The transition toward sustainable protein sources has led food scientists to re-evaluate the pistachio as…

Advanced Phytochemical Applications of Pistacia vera in Functional Beverage Systems and Molecular MixologyAbstract

As of 2026, the global beverage industry has pivoted from simple hydration to “functional indulgence.”…